If you’re searching for payday loans via eLoanWarehouse or wondering whether it’s safe, legit, or worth it—you’re in the right place. This in-depth 2025 guide walks you through everything you need to know: how their payday installment loans work, real customer concerns, hidden fees, and smarter alternatives.

We’ve also included trending user queries like “eloanwarehouse lawsuit“, “$800 payday loan“, “payday loans online“, and “bad credit payday loan approval” — all naturally answered within the content.

📅 What Is eLoanWarehouse?

eLoanWarehouse is a tribal lender operated by Opichi Funds, LLC. It offers installment-style short-term payday loans ranging from $300 to $3,000. Unlike lump-sum payday loans, these are paid back in biweekly or monthly installments over 6 to 12 months.

- No hard credit check required

- Same-day or next-day deposits

- Fully online application

This option sounds convenient but comes with legal and financial implications.

✅ Is eLoanWarehouse Legit?

Yes, but with serious caveats. As a tribal lender, eLoanWarehouse operates under tribal lending laws, which offer them sovereign immunity from most state regulations.

This means:

- You can’t sue them in state court

- Disputes go through tribal arbitration, not U.S. courts

- Consumer protections are weaker than with state-regulated lenders

This is why many users search for terms like “eloanwarehouse lawsuit” after facing repayment issues or aggressive debits.

💸 Common Fees, Interest Rates & Risks

eLoanWarehouse typically charges extremely high APRs, from 300% to 700%, depending on credit profile and history.

Hidden costs include:

- Processing or maintenance fees

- Penalties for missed payments

- Overdrafts from multiple auto-debits

Borrowers searching for “payday loans eloanwarehouse bad credit” should be aware that easy approval doesn’t mean easy repayment.

💬 Real Customer Reviews: The Good, The Bad, and the Ugly

People often search “eloan warehouse reviews” and “eloanwarehouse customer service” after dealing with these common issues:

- Difficult-to-reach phone support

- Surprise deductions from bank accounts

- Vague or unclear repayment terms

Many customers report feeling trapped in a debt cycle due to aggressive repayment structures and limited communication.

📱 eLoanWarehouse App: Useful but Not Without Risks

The eLoanWarehouse app lets users apply, repay, and manage loans. However, concerns include:

- Forced bank access via third-party linkers

- Face/Touch ID login issues

- App instability and crashes

Be cautious with personal banking details while using the app.

🔍 What Users Are Googling: Popular Questions Answered

“eloanwarehouse lawsuit”

While no public lawsuits exist, tribal lending laws make traditional legal recourse nearly impossible. Expect arbitration, not court.

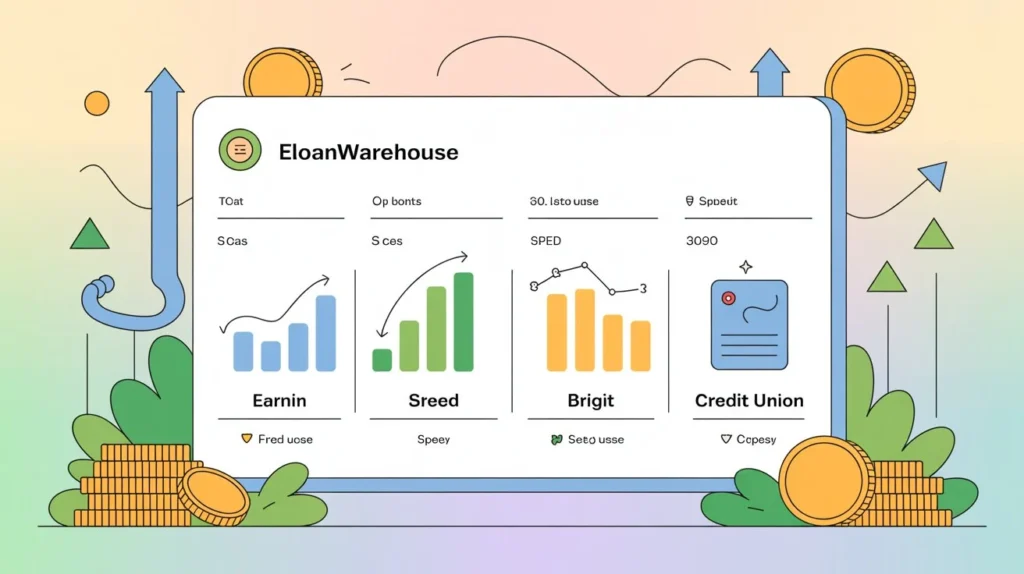

“loan companies like eloan warehouse”

Consider Earnin, Dave, Brigit, or credit unions — all of which offer more transparency and lower APRs.

“eloanwarehouse number” and “customer service”

Expect long wait times and minimal support if problems arise. Keep emails and payment screenshots for your records.

“payday loans online” / “online payday loans eloanwarehouse”

Yes, the platform is fully digital. But read the terms and disclosures carefully before signing.

“$800 payday loan”

Yes, $800 is a common loan size — but prepare for $1,600+ in total repayment depending on term length.

“payday loans eloanwarehouse bad credit”

Good news: bad credit is accepted. Bad news: you’ll likely face even higher APRs.

✉️ Is It Worth It?

Here’s a quick breakdown:

| Pros | Cons |

|---|---|

| Fast approval | Extremely high interest rates |

| No hard credit check | Limited legal protections |

| Works for bad credit | Unexpected fees and aggressive collections |

| Installment repayment model | Poor app and support experience |

This lender may offer short-term relief, but it’s rarely the best long-term financial choice.

⚡ Safer Alternatives You Should Know

| Service | Great For | Cost |

| Earnin | Interest-free cash advance | Optional tip |

| Dave | Small loans + budgeting | Monthly fee |

| Brigit | Overdraft safety net | Subscription-based |

| Credit Union Loans | Regulated short-term loans | Competitive rates |

These platforms help avoid payday loan traps by offering transparent terms and better support.

📆 FAQs

1. Can I get a loan with bad credit from eLoanWarehouse?

Yes, they approve loans based on income, not credit score.

2. How fast is the funding process?

You may receive funds same day or next business day.

3. Are there penalties for early repayment?

No. You can repay early to avoid excess interest.

4. Can eLoanWarehouse withdraw from my bank unexpectedly?

Yes, users report unauthorized or repeated debits.

5. Is the app reliable and safe?

Not always. Some users report login and security issues.

📌 Final Verdict

eLoanWarehouse payday loans offer speed and access when you’re short on options. But be warned: what you gain in convenience may cost you double or triple in interest, fees, and stress.

Before borrowing, explore safer paths like credit unions or trusted payday loan alternatives.